The 5-Minute Rule for Fortitude Financial Group

Table of ContentsNot known Details About Fortitude Financial Group Not known Details About Fortitude Financial Group Not known Facts About Fortitude Financial Group8 Easy Facts About Fortitude Financial Group ExplainedNot known Details About Fortitude Financial Group

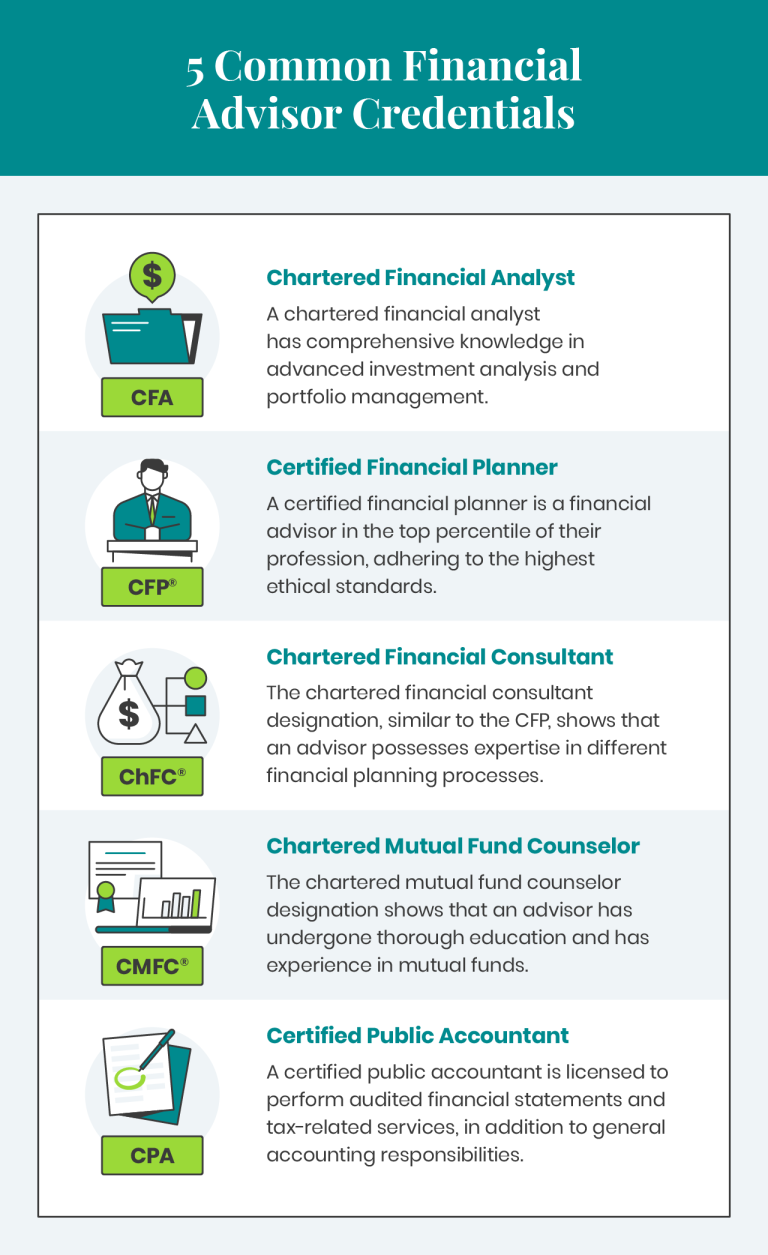

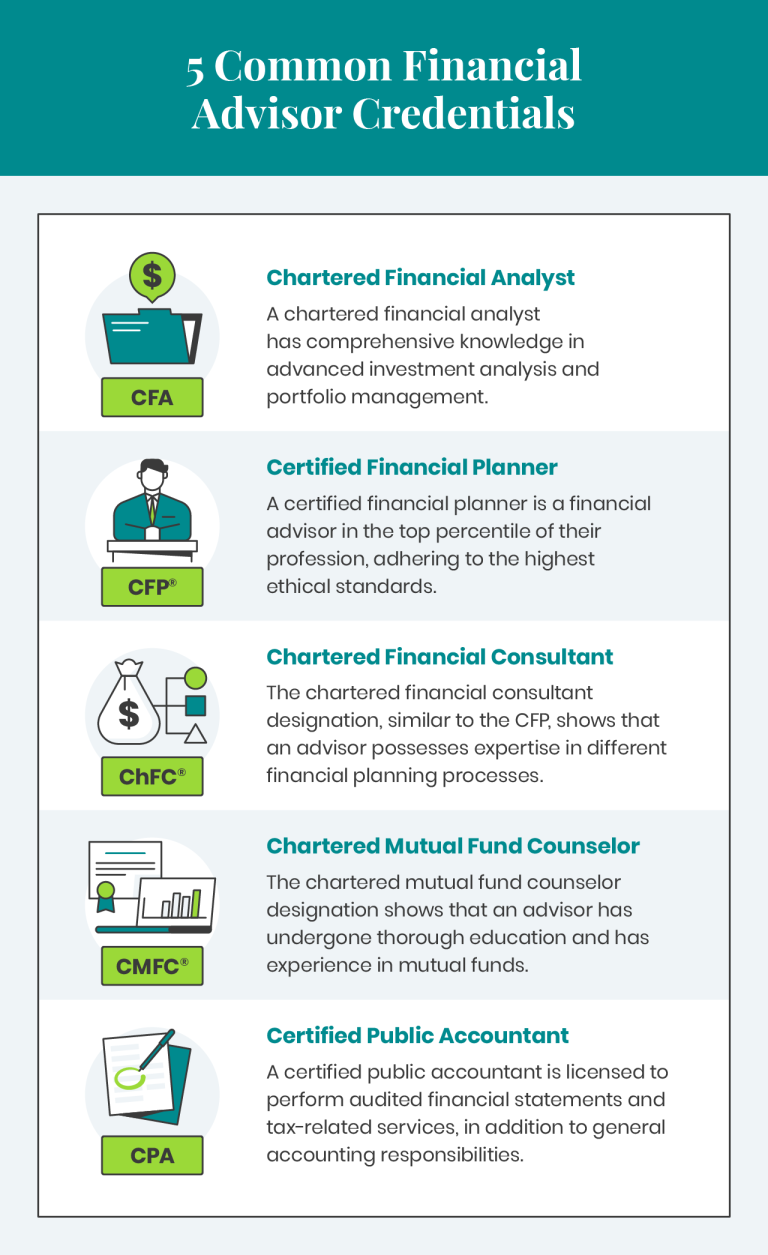

In a nutshell, an economic advisor helps people handle their money. Some monetary experts, commonly accountants or legal representatives who specialize in trusts and estates, are riches supervisors.Typically, their emphasis is on informing customers and giving threat administration, money circulation analysis, retirement planning, education planning, investing and much more. Unlike attorneys that have to go to regulation college and pass the bar or physicians who have to go to medical institution and pass their boards, monetary consultants have no details special requirements.

If it's not through a scholastic program, it's from apprenticing at an economic advising firm. As noted previously, though, lots of consultants come from other areas.

Or possibly someone that takes care of properties for an investment business decides they prefer to help individuals and service the retail side of the business. Lots of financial consultants, whether they currently have specialist levels or otherwise, go through qualification programs for even more training. A general economic expert qualification is the certified financial organizer (CFP), while an innovative version is the chartered monetary consultant (ChFC).

Fortitude Financial Group Fundamentals Explained

Normally, a financial consultant uses investment management, financial preparation or riches monitoring. This can be on an optional basis, which indicates the expert has the authority to make professions without your approval.

It will detail a collection of steps to require to achieve your financial objectives, consisting of a financial investment strategy that you can implement by yourself or if you want the expert's help, you can either hire them to do it as soon as or register for continuous management. Financial Services in St. Petersburg, FL. Or if you have details needs, you can work with the advisor for monetary planning on a task basis

Our Fortitude Financial Group Diaries

This means they need to place their clients' best rate of interests prior to their very own, to name a few points. Other economic advisors are participants of FINRA. This has a tendency to imply that they are brokers who also provide financial investment Visit This Link suggestions. Rather than a fiduciary requirement, they must follow Policy Benefit, an SEC guideline that was implemented in 2019.

Their names often state it all: Stocks licenses, on the various other hand, are extra about the sales side of investing. Financial experts that are also brokers or insurance agents have a tendency to have securities licenses. If they straight buy or offer supplies, bonds, insurance policy products or give economic advice, they'll require details licenses related to those items.

The most popular protections sales licenses consist of Collection 6 and Collection 7 classifications (https://www.provenexpert.com/fortitude-financial-group3/). A Collection 6 permit enables a monetary expert to offer financial investment products such as shared funds, variable annuities, device investment company (UITs) and some insurance products. The Collection 7 certificate, or General Securities permit (GS), permits a consultant to offer most kinds of protections, like typical and participating preferred stocks, bonds, choices, packaged financial investment products and even more.

10 Easy Facts About Fortitude Financial Group Explained

Constantly see to it to ask about economic advisors' cost timetables. To locate this information on your very own, visit the company's Kind ADV that it files with the SEC.Generally talking, there are two kinds of pay frameworks: fee-only and fee-based. A fee-only consultant's sole kind of compensation is via client-paid charges.

, it's vital to know there are a selection of payment approaches they may make use of. (AUM) for managing your money.

Based on the abovementioned Advisory HQ research study, prices usually range from $120 to $300 per hour, commonly with a cap to just how much you'll pay in total amount. Financial advisors can earn money with a taken care of fee-for-service model. If you want a standard monetary strategy, you may pay a flat fee to obtain one, with the Advisory HQ study highlighting ordinary rates varying from $7,500 to $55,000, depending on your property rate.

Fortitude Financial Group Can Be Fun For Anyone

When an expert, such as a broker-dealer, offers you a monetary item, she or he gets a certain portion of the sale amount. Some economic consultants who work for large broker agent firms, such as Charles Schwab or Fidelity, get a wage from their employer. Whether you require a monetary advisor or otherwise depends upon just how much you have in possessions.